Foxilynch: Research Foundations for a Trust-First Refurbished Tech Ecosystem

Introduction

India’s refurbished electronics market is growing fast, yet buyers remain hesitant, unsure about repair quality, part authenticity, hidden problems, and unreliable warranties. The research behind Foxilynch set out to uncover why this hesitation exists and what would make users genuinely trust refurbished products.

This article summarizes the research foundation of Foxilynch — the insights, user needs, pain points, and market gaps that shaped the service solution.

A link to the full case study will appear at the end of the article.

Why This Problem Matters

The demand for second-hand electronics in India is huge, especially among students, young professionals, gamers, and budget-conscious buyers. But beneath that demand lies something more complex — uncertainty. Potential and existing users mainly worry about:

Fake or mismatched parts

Short or unreliable warranties

Lack of grading standards

Repair shops that operate without any transparency

Service updates that are impossible to track

Hidden defects

Even when the price seems right, the experience rarely inspires confidence. This gap became the starting point for the Foxilynch research.

Primary Research: What Users Actually Experience

To understand the ground reality, I conducted:

18 In-Depth Interviews

with buyers, sellers, repair customers, and store staff across CeX and Cashify outlets.

Interviews uncovered recurring anxieties about hidden faults, unreliable warranties, and counterfeit parts.

Click to access the Detailed Interview Interpretations

Contextual Inquiry & Store Shadowing

I observed grading workflows, pricing conversations, repair intake procedures, and customer interactions.

This revealed inconsistencies in grading, unclear communication, and a negotiation-heavy environment.

Quantitative Survey

A structured survey validated interview insights, showing:

Warranty & repair history transparency were the strongest trust levers.

Price sensitivity and social stigma remained major barriers.

Click to access the Survey Results

What People Actually Struggle With

Across all conversations and observations, four themes appeared everywhere:

Unclear Repair Quality

People can’t verify who repaired the device, what was replaced, or whether the parts used were genuine.

Confusing Warranty Coverage

Users often receive a warranty, but with vague terms and conditions or poor post-purchase support.

No Standard Grading System

Vague labels like “Good,” “Excellent,” or “Like New” mean different things depending on where the device is purchased.

Fragmented After-Sales Support

Finding updates, reaching technicians, or tracking repairs is inconsistent and often stressful.

These breakdowns create emotional uncertainty, which is far more damaging than the risk itself.

Behavioural Patterns and Motivations

People don’t necessarily reject refurbished goods, but they don’t want to feel blindfolded. Some clear patterns emerged across our research:

Trust First, Price Second

Even price-sensitive users will pay more for clarity and reliability.

Proof Matters

QR codes, repair records, technician identity, and genuine-part verification are powerful reassurance triggers.

Human + Digital Works Best

Users prefer a hybrid model: digital transparency with the reassurance of a physical touchpoint.

Consistency Builds Confidence

From grading to timelines, users want predictable systems.

Click to view the Affinity Mapping of Foxilynch

Market & Ecosystem Mapping

Competitive Landscape

A teardown of CeX, Cashify, OLX, OEM centers, and informal repair shops showed:

P2P platforms = lowest trust

Informal repair ecosystem = zero accountability

OEM centers = highest trust but highest cost

Organized refurbishers = convenience but incomplete transparency

Click to view the Competitive Landscape

Market Size & Momentum

India’s refurbished electronics market is growing rapidly, driven by cost sensitivity and expansion of the “right to repair” movement.

This confirmed a large TAM for a trust-first service.

Ideal User Profiles

Using primary research, four core user types emerged:

Warranty Seekers – reliability above all

Buyers – affordability + trust

Sellers – convenience + fair price

Repair Customers – transparency + accountability

These archetypes guided how different parts of the service needed to behave.

Click to access the Ideal Client Profiles in detail (5 in total)

Journey Mapping & Breakdown of Pain Points

Across seven journey maps, consistent friction points appeared:

Ambiguous device quality

Missing repair history

Confusing warranties

No clarity on pricing logic

Emotional unease during the purchase

Mapping emotional highs and lows helped identify the exact moments where trust collapses — and where Foxilynch could intervene.

Click to view the Detailed Customer Journey Maps to gain a deeper insight into the friction points

Synthesis: What Users Need (Not What They Say They Want)

Across all research, three needs stood out:

Verified authenticity

A device passport showing part history, repairs, and grading.

Predictability and clarity

Warranty terms that are simple, visible, and QR-verifiable.

Ethical, reliable service

Even in digital journeys, people want physical validation.

The Opportunity Ahead

With rising device costs, a growing circular economy, and heightened awareness of repair rights, this market is ready for change. What people want isn’t cheaper devices, they need assurance, clarity, and accountability.

The research phase revealed exactly where those gaps lie and laid the groundwork for a service that could bridge them.

Conclusion: Laying the Groundwork for the Solution

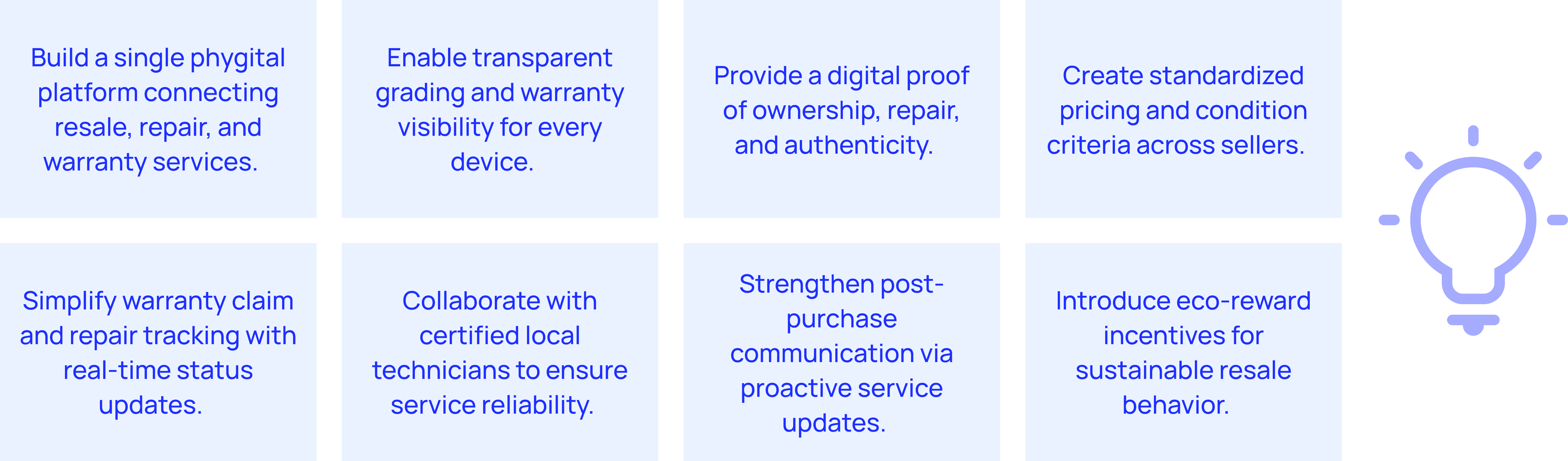

This research established the foundation for Foxilynch: a phygital, trust-centered platform with transparent device passports, verifiable warranties, and evidence-backed repairs.

The solution project builds directly on these findings, translating insights into service blueprints, user flows, and a full UI/UX system.